Funding Small Businesses

If you are looking for a loan with low interest rates, suitable terms, and an extended repayment period, an SBA loan could be the solution for you. The application process can be complex and overwhelming, that's why we are here to lend our expertise to you.

Your Trusted Funding Partner

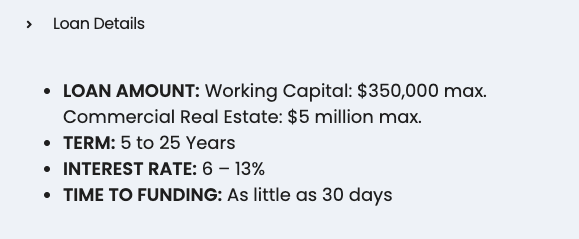

SBA 7(a) Loans are incredibly flexible and can finance a wide variety of business needs. Whether you’re interested in expanding your business, funding an equipment purchase, purchasing additional inventory, or acquiring new real estate, an SBA 7(a) loan can help you.

Get started now

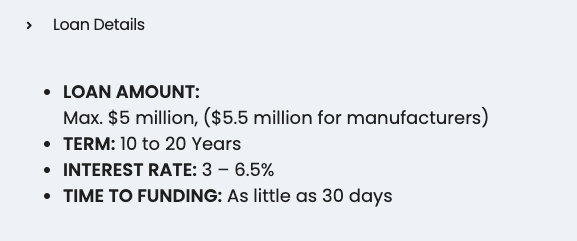

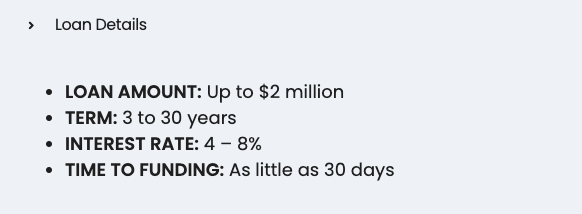

A CDC/504 is another popular type of SBA loan. CDC/504 loans are most often used to purchase major assets with long life spans. Examples of things commonly funded with CDC/504 loans include real estate, heavy equipment, and machinery. CDC/504 loans require a low down payment and have fixed interest rates with terms up to 25 years.

Get started now

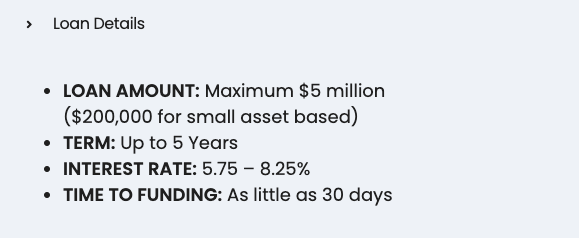

SBA CAPLines (Lines of Credit) are a working line of credit program designed to assist small businesses with short-term and cyclical capital needs. In most cases, these products are only available to companies that already have a traditional SBA 7(a) or CDC/SBA 504 loan.

Get started now

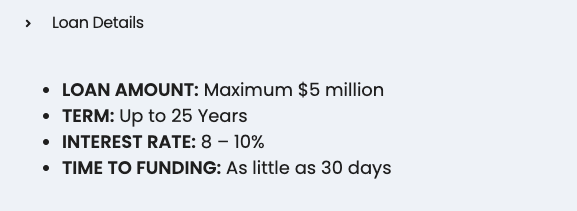

SBA Export Loans are designed to help small businesses expand into foreign markets. There are three types of SBA export loans, including Export Working Capital Loans, Export Express Loans, and International Trade Loans.

Get started now

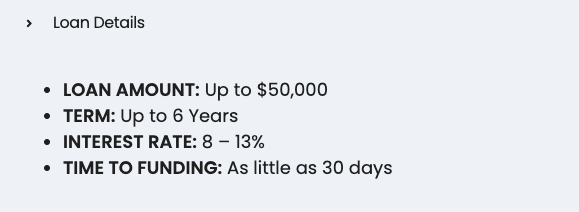

The SBA MicroLoan Program provides smaller loan amounts with the goal of assisting small businesses with their working capital. This capital may be used for a wide variety of purposes, including but not limited to inventory, machinery, raw materials and supplies, labor costs, and marketing.

Get started now

The SBA provides disaster loans for small business owners whose premises have been damaged or destroyed by natural disasters. There are three types of SBA Disaster Loans available, depending on the type of damage your business has sustained.

Get started now

Simply provide essential details about your business, and upon approval, you can request funds and have them deposited into your account in as little as 48 hours.

Minimum Qualifications

Complete an online funding application

Get best offers from our provider network

Receive funds in as little as 24 hours!

See what our clients have to say about their experiences working with us. Our satisfied customers share their success stories and how we helped them achieve their business goals.

This is a placeholder we can either add testimonials or remove the section.

Gerry Kellmen

Head of financeThis is a placeholder we can either add testimonials or remove the section.

Gerry Kellmen

Head of finance

At Live Pay Lending we specialize in providing comprehensive financial services tailored specifically for small business owners.